On 15 March 2024, ADBA submitted its formal response to the Scottish Government's consultation on…

UKEF support to fossil fuels questioned in the House of Commons

House of Commons Environmental Audit Committee has presented the UK Export Finance (UKEF) 19th Report covering the period 2017-2019 to the House of Commons Environmental Audit Committee. UKEF is UK’s export credit agency.

The report critics the high level of support for fossil fuel energy projects, £2.5 billion out of £2.6 billion dedicated to the energy sector in the period 2013-2018, 96% of the allocated budget. While this trend seems to be rebalancing in the investment in high-income countries (96% of the budget to renewables and 4% to fossil fuels), this is still not the case in low and middle-income countries (over 99% invested in fossil fuels). This came at the time that the largest global equity fund, Norway’s Government Pension Fund Global, announced a divestment $13bn in fossil fuels, the largest one of its nature.

This contrasts with the fact that AD’s benefits can be particularly felt in developing countries, who may not have access to proper sewerage, organic waste collections, or access to power grids. AD and its products can help create local employment, absorb wastes and create local power networks, leading to a cleaner environment and local economic development.

Critics considered by the Committee include the Catholic Agency for Overseas Development describing UKEF’s activities as the “’elephant in the room’ undermining UK climate and development leadership“ and former UN Secretary General, Ban Ki-moon urged that UKEF’s policy needs “recalibration” to meet international climate trends and obligations.

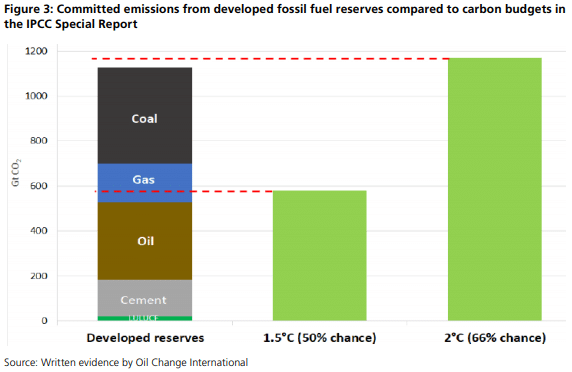

Despite the UK’s signing of the Paris Agreement, the majority of UK Export Finance’s overseas energy investment supports fossil fuels. This is leading to an increase in greenhouse gas emissions, carbon lock-in and the risk of stranded assets. Such support severely undermines the UK’s domestic and international climate action as well as its commitment to the UN’s Paris Agreement on Climate Change.

E3G

Funding fossil fuels also undermines our International Development goals. The £4.8 billion total UKEF support for fossil fuel projects between 2010–16 is nearly equal to the UK’s total spend on its International Climate Fund for a similar period, 2011–17, which came to £4.9 billion.

Global Witness

Although UKEF support just represents 0.02% of global oil and gas business, this sends a clear signal and might leverage investments in the sector in a direction contrary to the UK's recently acquired commitment to achieve net-zero emissions by 2050. The UK also committed as part of G7 to end subsidies for fossil fuels by 2025, a statement repeated every year within the G20 since 2009.

As a result, the following recommendations were made:

- UK Government should set out how UKEF will work towards net-zero emissions by 2050 to show climate leadership and a willingness to align the UK’s domestic and international approaches to job creation and climate change.

- Use different measures to determine whether UKEF subsidises fossil fuels: the “price gap” method, and publish a measure of its inventory support for fossil fuels using the OECD method.

- Government should legislate to ensure compliance with the UK’s obligations under the Paris climate agreement and other national and international climate and environmental commitments including SDGs.

- UKEF should report on the forecast and actual emissions of all projects it supports, as well as the portfolio totals, in a single document, so that it is easy to access and compare projects.

- UKEF’s support for new fossil fuel projects should finish by the end of 2021.

- UKEF should commit to only support British businesses in projects that support the UK's climate goals. In supporting a new energy project, UKEF should show how this supports transition to net zero emissions by 2050.

- Projects supported by UKEF should be able to demonstrate that they have considered a range of potential lower-carbon and renewable options, and that they have selected the option with the lowest feasible emissions.

- UKEF should state how its strategy will support a 'just transition' for workers in the UK who currently benefit from its support, and how this approach will support decent work in the areas affected.

- UKEF should follow Sweden’s Export Credit Corporation (SEK) in introducing a 5% cap on gross lending to fossil fuel operations (coal oil and gas) as a proportion of total support. As with the UK’s domestic carbon budgets, this cap should progressively reduce in size, and should align with supporting net-zero emissions by 2050.